India’s Housing Market Is Holding Firm — But the Buyer Has Changed

Knight Frank H2 2025 Residential Market Outlook highlights stable housing sales at 3.48 lakh units, rising prices, and a decisive shift toward premium homes. Knight Frank India’s latest flagship report, India Real Estate: Office and Residential Market – H2 2025, shows that India’s residential housing market has entered a phase of consolidation at historically high levels. Volumes remain resilient, prices continue to rise across cities, and demand is increasingly skewed toward higher-value homes—reshaping the opportunity landscape for developers, suppliers, and building products & home improvement (BPHI) brands.

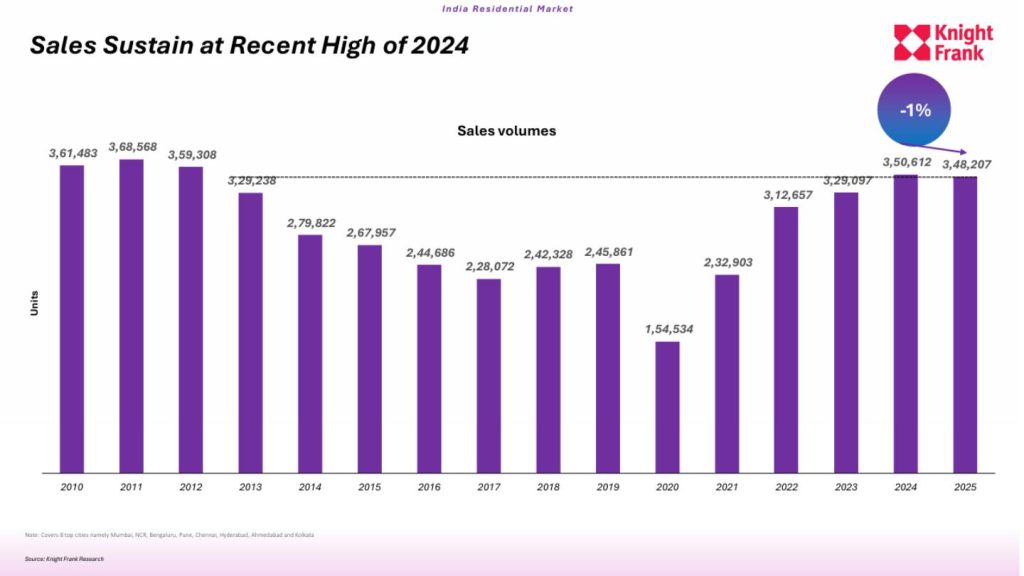

Sales Consolidate at Elevated Levels

Residential sales across India’s top eight cities closed 2025 at 3,48,247 units, a marginal

1% year-on-year decline, but still among the strongest annual performances of the past

decade. After a multi-year upswing, the market is no longer expanding rapidly—but it is

clearly holding ground.

H2 2025 Records Strongest Absorption Since 2013

The sharper signal lies in the second half of the year. H2 2025 sales at 1,78,406 units marked the highest H2 absorption since 2013, underlining sustained end-user demand

despite rising prices and a more selective buyer mindset. Volumes remained largely

comparable with the previous year, pointing to stability rather than volatility.

City Performance Diverges as Markets Mature

Mumbai retained its position as the country’s largest residential market with 97,188 units sold, accounting for nearly 29% of total sales and registering 1% YoY growth. Bengaluru remained broadly stable, supported by steady end-user demand and a balanced supply pipeline. Chennai emerged as a standout performer with 12% YoY growth, while Hyderabad posted 4% growth, reflecting improving traction beyond the traditional top two markets.

In contrast, NCR and Pune recorded declines of 9% and 3% YoY respectively, largely due

to elevated base effects and selective activity in higher-value corridors rather than a broad-based demand slowdown.

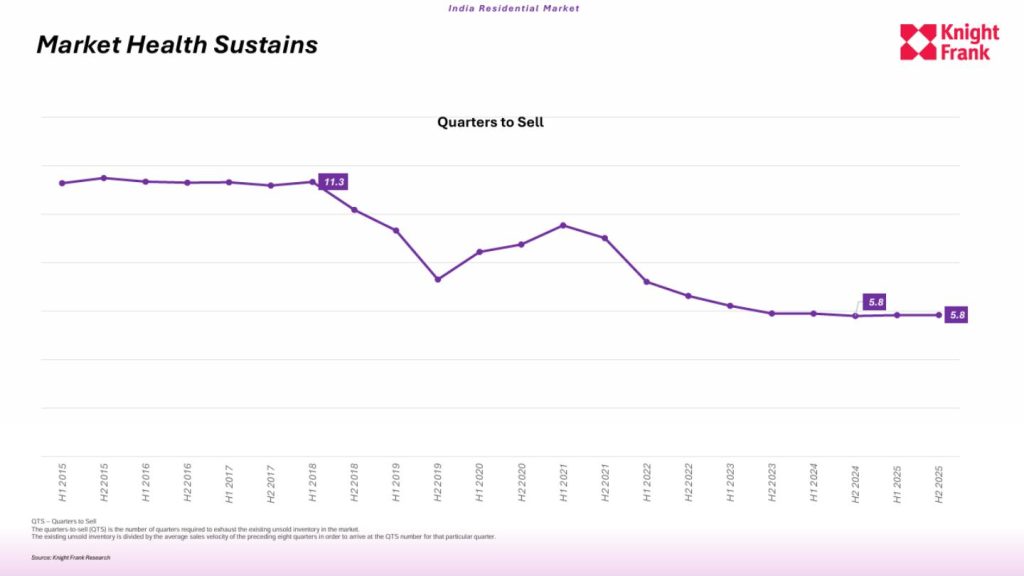

Market Health Remains Stable Despite Higher Inventory

Even as new launches continued to outpace sales in most cities, market health indicators remained firm. The quarters-to-sell (QTS) ratio held steady at 5.8, signalling disciplined supply additions and efficient inventory absorption. This stability differentiates the current cycle from earlier boom phases driven by speculative excess.

Price Growth Sustains Without Derailing Demand

Price appreciation remained a defining feature of the residential landscape in 2025. Weighted average residential prices rose across all key markets, led by NCR with a sharp

19% YoY increase, followed by Hyderabad (13%), Bengaluru (12%) and Mumbai (7%).

This upward movement was driven by rising land and construction costs, alongside a higher concentration of premium launches. Importantly, buyers have continued to absorb these increases, reflecting confidence in income stability and long-term urban

fundamentals.

Premium Housing Becomes the Market’s New Centre of Gravity

A key insight from the Knight Frank H2 2025 Residential Market Outlook is the structural

premiumisation of housing demand. Homes priced above ₹1 crore now account for 50%

of total residential sales, with volumes rising 14% YoY to over 175,000 units in 2025.

Improved affordability metrics, rising household incomes and evolving buyer aspirations

have reduced the need for compromise on size, quality and location. Demand is increasingly gravitating toward mid-to-premium and premium housing formats.

Affordable Housing Continues to Lose Share

At the lower end of the spectrum, the sub-₹50 lakh segment contracted sharply, with

sales declining 17% YoY and its share dropping to 21% of total transactions, down from

nearly two-thirds of the market as recently as 2022. Structural constraints—including high land costs, limited availability of economically viable urban stock, tighter buyer profiling and access to formal credit—continue to weigh on this segment.

What the Data Signals for Residential Developers

The Knight Frank H2 2025 Residential Market Outlook shows that the market is no longer rewarding scale alone. Growth is increasingly driven by:

- Mid-to-premium and premium housing formats

- Stronger design, layout and amenity differentiation

- Phased, disciplined launches that protect cash flows and inventory metrics

Affordable housing in core urban markets remains structurally challenging, pushing developers to rethink location strategies and partnership models.

Implications for Building Products & Home Improvement (BPHI) Brands

For BPHI brands and suppliers, higher ticket-size homes translate directly into greater

specification intensity per unit—from modular kitchens and fittings to surfaces, hardware, lighting and smart home solutions. As developers compete on differentiation rather than pricing, design-led collaboration with suppliers is becoming central to sales velocity.

2026 Outlook: Discipline Over Expansion

Looking ahead, rapid volume expansion appears unlikely after two peak years. Instead,

stable absorption, selective price appreciation and calibrated supply additions are expected to define residential market activity in 2026.

The Knight Frank H2 2025 Residential Market Outlook makes one thing clear: India’s housing market has entered a more mature, disciplined phase—less exuberant, but structurally stronger. For developers, suppliers and building products & home improvement brands, the next phase of growth will favour strategy, execution quality and long-term positioning over short-term volume chasing.

ALSO READ