Average home sizes up 17% in 2 years across top cities, according to the latest research

from ANAROCK Group, signalling a structural shift in the configuration of urban housing

supply — and in the revenue logic of the building products ecosystem.

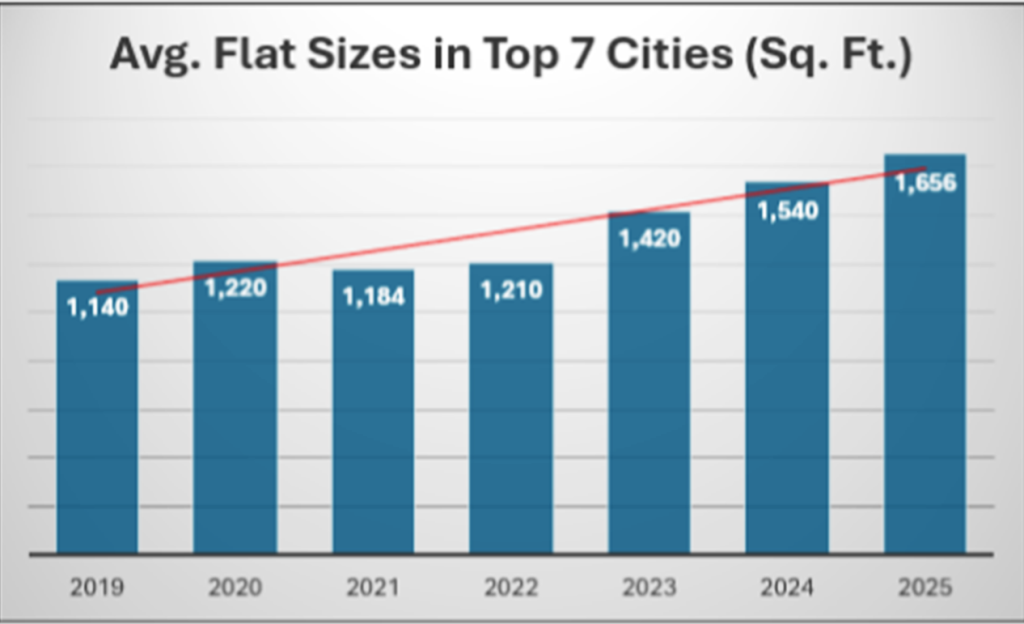

Across the top seven cities, average flat sizes have increased from 1,420 sq. ft. in 2023 to approximately 1,676 sq. ft. in 2025 — a 17% jump in two years. In 2024 alone, the average stood at 1,540 sq. ft., marking an 8% annual increase. The data indicates that developers are not merely responding to demand, but actively reshaping supply toward larger configurations.

According to ANAROCK Chairman Anuj Puri, 3 and 4 BHK homes — often with added study

rooms — have now become mainstream across several markets. Luxury housing, particularly homes priced above ₹1.5 crore, is driving much of this expansion.

NCR and Hyderabad Drive the Upsizing Cycle

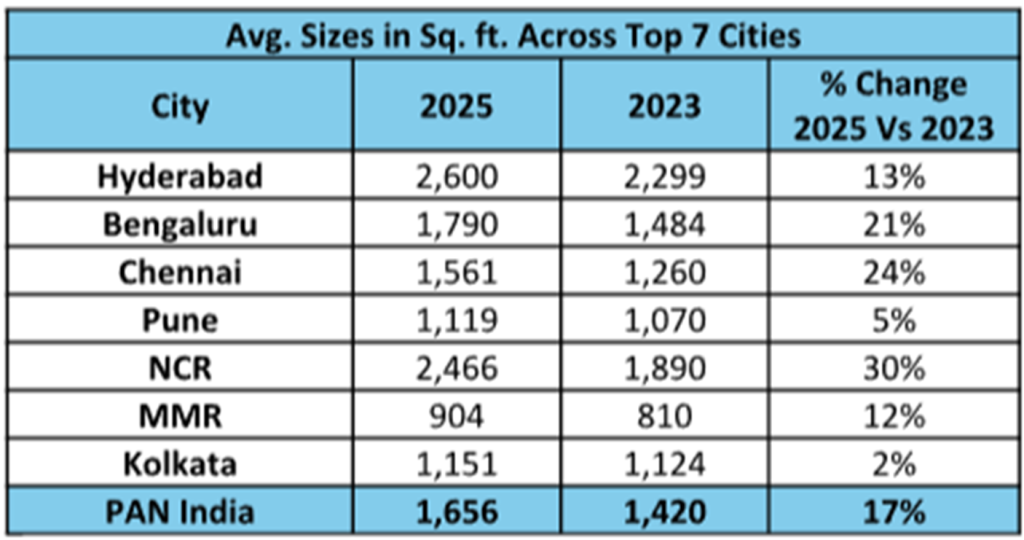

NCR recorded the sharpest two-year increase among the top cities, with average flat sizes

rising 30% — from about 1,890 sq. ft. in 2023 to roughly 2,466 sq. ft. in 2025. The shift aligns with a decisive pivot toward luxury supply: in 2023, luxury homes accounted for 40% of new launches in NCR; by 2025, their share had climbed to 80%.

Hyderabad continues to lead in absolute size, with average flats touching nearly 2,600 sq. ft. in 2025, up from 2,299 sq. ft. in 2023. The city also saw the strongest one-year growth, with a 24% rise between 2024 and 2025.

Chennai and Bengaluru have followed a similar trajectory. Chennai saw a 24% two-year

increase to 1,561 sq. ft., while Bengaluru recorded a 21% rise to nearly 1,790 sq. ft. Both

cities reflect growing appetite for larger homes in premium micro-markets.

At the other end of the spectrum, the Mumbai Metropolitan Region (MMR) remains the most space-constrained, though even here average sizes increased 12% — from 810 sq. ft.

in 2023 to 904 sq. ft. in 2025. Kolkata and Pune posted relatively modest growth of 2% and 5%, respectively, with Pune the only city to see a marginal dip over the past year.

The Post-COVID Structural Shift

The longer-term view underscores the depth of this transition. Between 2019 and 2025,

average home sizes across the top seven cities have risen 45% — from 1,140 sq. ft. to

approximately 1,656 sq. ft. NCR alone has witnessed a near doubling (97%) over this six-year period, while Hyderabad has recorded a 53% expansion.

The pandemic appears to have permanently altered spatial expectations. Home offices,

flexible rooms, larger kitchens, and enhanced storage have shifted from aspirational add-

ons to baseline expectations in many segments.

Why This Matters for the Building Products Ecosystem

For building products and home improvement brands, this is not just a housing statistic — it is a material consumption signal.

Larger apartments increase specification intensity per unit. More built-up area translates

into longer kitchen runs, additional wardrobes, expanded flooring coverage, higher paint

and surface consumption, and greater integration of lighting, automation, and climate

solutions. A 2,400–2,600 sq. ft. apartment in NCR or Hyderabad allows for island kitchens,

walk-in wardrobes, dedicated study rooms, utility expansions, and entertainment spaces —

each adding layers of product demand.

Importantly, the growth is concentrated in premium and luxury segments, where price

sensitivity tends to be lower and conversations shift toward performance, durability, brand

value, and design differentiation. For kitchen and cabinetry brands, the mainstreaming of

large-format homes strengthens the case for premium hardware systems, engineered

panels, built-in appliances, and modular storage solutions.

In effect, while overall housing volumes may fluctuate across cycles, the value per unit is

expanding. As average home sizes grow, so does the revenue opportunity embedded within

each dwelling.

For the building products and home improvement industry, the story is increasingly less

about how many homes are being built — and more about how much goes into each one.

ALSO READ