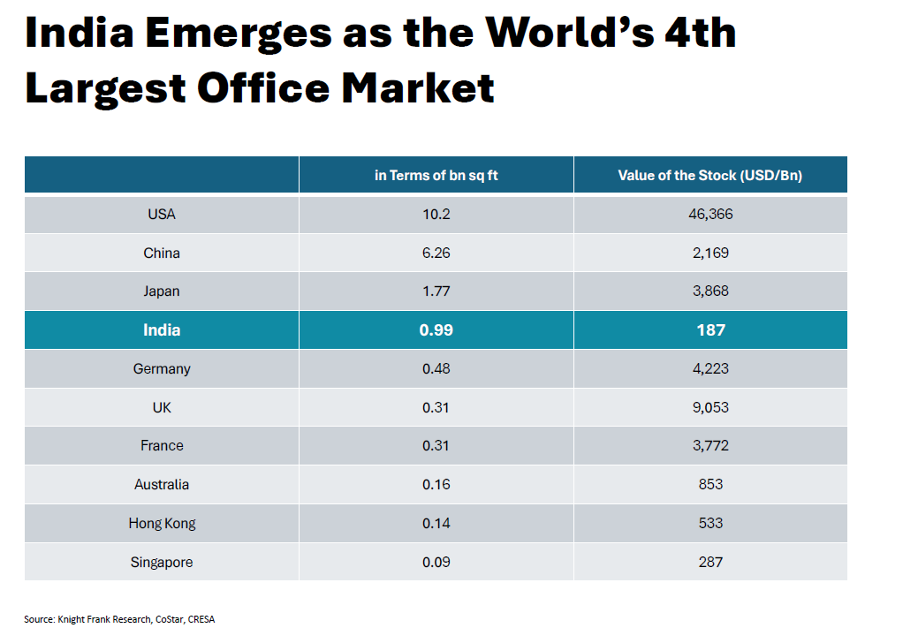

The India office space market will soon become the fourth largest globally after the United States, China and Japan — a feat made possible by the growth in global capability centres (GCC).

With 8.6% CAGR growth in office supply over the last 20 years, the country’s market stock is set to cross 1 billion square feet (bn sq ft) by Q3 this year, according to a recent report by property consultant Knight Frank. As of June 2025, the cumulative office stock across the Top 8 cities stood at 993 million sft.

The United States has an office stock of 10.2 billion sft, China has 6.26 billion sft and Japan has 1.77 billion sft.

GCC Thrust to Growth

GCCs, a major force driving the India office space market growth, have played a crucial role, leveraging the domestic market’s affordability and the rising supply of Grade A space (53% of total supply).

Observing that an ecosystem of world-class developers, investors and occupiers helped in scripting this growth story, Shishir Baijal, CMD of Knight Frank India, says, “… it’s (1 billion sft threshold) not just a number, it reflects the growing institutionalisation, maturity and global relevance of India’s office market… It also reinforces India’s positioning as a global economic powerhouse, offering a compelling value proposition for multinational businesses and institutional capital.”

A separate report by CBRE points out that “expansion of GCCs, driven by consolidation and new entrants, is projected to account for 35-40% of office space absorption in key Indian cities in 2025”.

Of the total India office space market, secondary business districts (SBDs) account for the highest share at 45%. Peripheral business districts (PBDs) have a 36% share.

The Knight Frank report highlights how India’s office market has scaled both in volume and quality. From under 200 mn sft in 2005 to nearly 1 bn sft in 2025, the expansion underscores India’s emergence as one of the fastest-growing and most future-ready office markets globally.

Tech Value Addition

The cherry on the cake is that the expansion is a value-driven transformation with technology at the forefront. This is going to help India add its next billion square feet by 2036–2041, depending on the pace of expansion. At a 12.7% CAGR, supported by strong economic momentum and formalisation, the milestone could arrive by 2036.

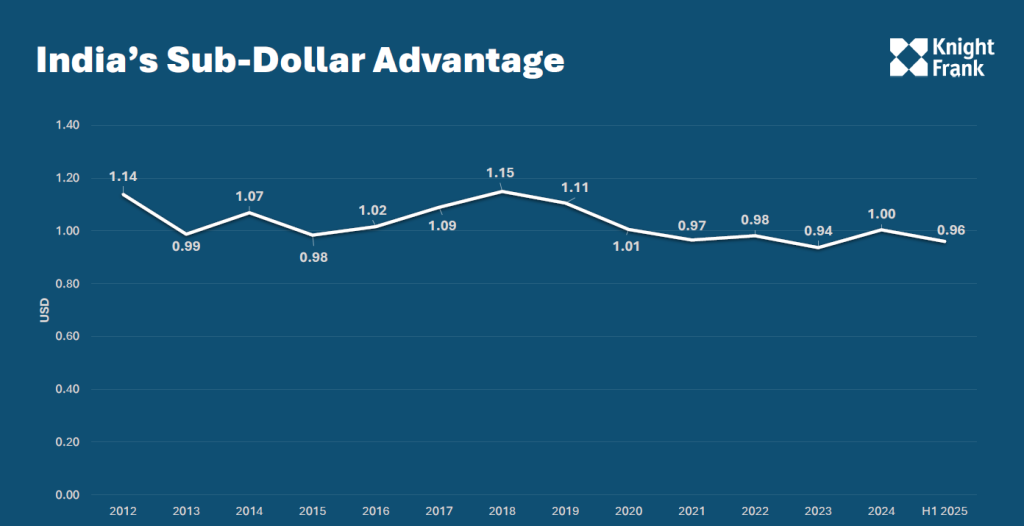

Defining the specific current demand in the India office space market, Viral Desai of Knight Frank India says, “As occupiers increasingly prioritise ESG compliance, productivity, and flexibility, the spotlight is firmly on asset quality, location efficiency, and user-centric design. In this context, India’s ability to offer modern, tech-enabled, green-certified workspaces at sub-dollar rates presents a compelling proposition for global enterprises looking to optimise costs while enhancing workplace experience.”

A game-changer in the office space market in India has been retrofitting, which has brought out the opportunity in ageing assets. For instance, retrofitting transformed a legacy tower in Mumbai into an energy-efficient Grade A address, pushing up the rent by 56%.

The Knight Frank report states that the post-retrofitting potential of the legacy office space in the country is Rs 4,81,500 crore to Rs 7,56,600 crore.

NCR Second Largest Office Market

Of the Top 8 Indian cities in the office space market, NCR is one of the most diversified and strategically balanced, with a total office stock of 199 mn sft (20%), just after Bengaluru with 229 mn sft (23%). Mumbai is in the third position with 169 mn sft (17%).

With a 7.4% CAGR since 2005, the region’s growth has been underpinned by consistent demand across sectors and ongoing infrastructure development.

Unlike the national story, where central business districts (CBDs) account for 19%, in NCR, the CBDs contribute 44% to the growth trajectory — the highest among all metros in the country. It is followed by SBDs and PBDs with 41% and 15%, respectively.

NCR’s commercial real estate market is split between modern, investment-grade assets and legacy office clusters. As of H1 2025, 43% of the total stock is classified as Grade A, reflecting sustained investments in new-age campuses and greenfield developments. Another 55% falls under Grade B, mostly in older Delhi submarkets and older towers in Gurugram and Noida.

With increasing emphasis on ESG compliance, wellness features and hybrid readiness, NCR is seeing growing traction for asset repositioning and retrofitting, particularly in the CBD and SBD zones.

“From Gurugram’s premium office corridors to Noida’s institutional ecosystems and Delhi’s timeless appeal, NCR continues to be a magnet for both domestic and global occupiers. With ongoing infrastructure enhancements and progressive policy support, the region is well poised to shape the next wave of commercial real estate growth in India,” says Anand Patil, National Director — Occupier Strategy and Solutions and Industrial & Logistics (NCR), Knight Frank India.

Between 1990 and 2025, the India office space market has evolved owing to a tech boom, IT/ITES expansion and policy reforms. However, the COVID-19 pandemic put brakes on the growth run, bringing the rate down to 17% in 2020-23 from 31% in 2015-19. But it soon jumped onto the recovery path to steer the course towards a positive performance. With long-term economic fundamentals, favourable demographics, digital transformation and a sustained focus on developing sustainable workspaces, the growth will only see an uptrend from here.