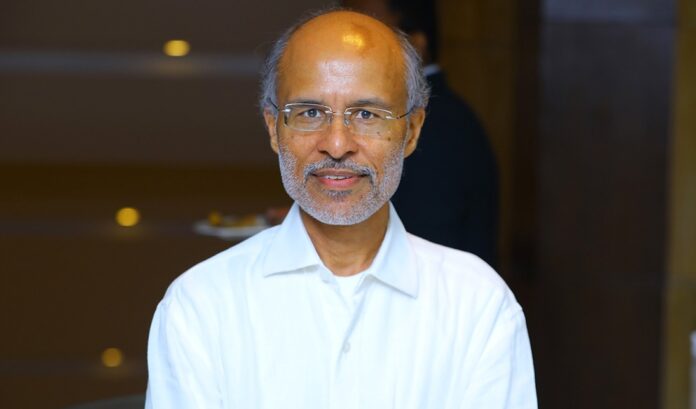

The emerging discipline of Complex Choices explores the rationale behind defining purposes, generating ideas, and dissecting decisions, thereby increasing probability of success in personal life, organisations or public policy. Prof Anil K Sood, founder at the Institute for Advanced Studies in Complex Choices (IASCC), explains the applications of this intriguing subject, and discusses the government’s enforcement of lockdown and economic management as well as US-China trade war from the prism of Complex Choices.

How critical is the study of Complex Choices? What role does it play in public policy-making?

The key to growth is investment and consumption decisions we make. The investment decisions of individuals are linked to the investment decisions of corporates, which in turn, are connected to investment decisions of individuals and the government. This is how complexities build into our choices, as a high degree of interdependence exists among them. These complexities and interdependence call for studying the decisions outside of the discipline of economics, finance, and public policy.

For example, my decision to buy a car will rely on the availability of quality public transportation; my need for buying a car declines if reliable public transportation is available. If the government chooses to invest on public transportation ahead of demand, then private investment which would go in to two-wheelers or cars can be redirected to other areas such as education and healthcare which help raise the standard of living. Various studies point out that it is cheaper to have public transport from the long-term economic perspective. So, it makes sense to invest in public transport and not encourage people to spend monies on private vehicles.

But, if we want to generate employment, the automobile comes across as an employment-intensive industry that does not take much time to set up an assembly unit, compared to other industries. Therefore, you would need to encourage investment in private transport. So, how do you make this trade-off? We study these decisions and make the choice which is socially and economically useful from a long-term perspective.

How does the Complex Choices discipline benefit the corporate sector?

While working with the corporate sector, we often significantly focus on productivity as well as bringing value for customers. We try to find out how an organisation can improve productivity by improving its effectiveness of expenditure. In my observations, most organisations struggle with managing effectiveness, which means how their spending at a given point of time will benefit customers; we evaluate if the expenditure incurred is necessary. Such enquiry helps in increasing the ability of an organisation to deliver the needs of customers at the right price. If customers do not see value, they will not pay the required price. This situation compels companies to consider discounting and get involved in price competition, which leads to a downward spiral.

The government had enforced a nationwide lockdown to control the spread of the novel coronavirus. While some felt that the decision was needed, others argued that it was not required as India was witnessing a slower rate of Covid-19 infection compared to Italy and the US, and had fewer positive cases. How do you view the decision?

I would have introduced the idea of uncertainty. In February and March, we did not know much about the novel coronavirus and its impact on human health. We had very little information coming out of China and the US. We were sitting on an uncertain or indeterminate situation, where no one had an understanding or possibility of gaining a comprehensive understanding of the virus. In view of this, we cannot model these situations, but can only create scenarios. We have to ask if this is how the virus spreads and impacts human health, then this is the cost that will emerge. So as a nation or society, are we willing to bear the cost or is it worth bearing it?

In the second scenario, if it spreads fast, the virus will have a limited impact on us as India’s population is young and can recover faster; long-term health impact will not be too bad. On the other hand western countries have an older population and experience different weather conditions, and may have to see a more negative impact.

To me, the chances of experiencing widespread negative impact are relatively lower in India than in the western countries. Considering this scenario, we will ask if a total lockdown is the solution? Can we isolate the older population? How can we enforce precautionary measures for people who work in close quarters? So, we start to apply the principles of segmentation used in marketing to Covid management.

How do you assess the government’s economic management for these unprecedented times?

Our country’s economic management has been relatively poor prior to the pandemic. Covid has only made it worse. We were struggling to grow for at least last three years. Once we shut down our economy without prior notice of at least a week, we had come to a situation where our economy collapsed in the first quarter with GDP declining by over 23%.

We should look at pre and post-Covid periods simultaneously to be able to assess if we are making sensible and sensitive choices. In governance, you must also be sensitive to the plight of the people who are going to be left helpless. When you enforce a policy instrument like lockdown, it is not only rationale that matters but also wisdom in combination with sensitiveness. We saw migrant labourers and millions of people trying to manage on their own. It was not the wisest thing to do from the social-economic perspective. If we enforce such lockdowns, we have to make sure that we provide healthcare to those who are stranded and had lost employment without enough savings.

Why do you think that India has not been growing for the last three years? What are the perennial problems stalling growth?

If we look at our long-term trajectory, we do not have concerns. It is growing for the last 30 years. If we look at the last three years, we are marginally down to 7% from 7-8%; it is a marginal change from the long-term perspective. In per capita growth rate, the story is not too bad either as the growth rate has been increasing from 2012 onwards; our growth rate went up 6.8% and down by one percentage. This is not a bad number, because overall universally it is 5%-plus.

If I see the period of GST implementation, our growth rate has only been declining. Private consumption has been declining; capital investment has more or less collapsed. Our capital investment has decreased from 30-40% of GDP to 32%. So, two of our biggest drivers of growth have collapsed. While government investment is reasonably steady, it is unable to compensate for the decline.

Our households are not in a position to spend as real earnings have not been growing for the last three years, salary increases have not been the same, and profitability for corporates has not been the same. Moreover, our economy was not expecting demand to grow in the marketplace and that led to a decline in capital investment. In the pre-Covid period, we did not have any large engines of growth. Post-Covid, the government has to spend significantly without worrying about fiscal deficit and credit ratings.

We have a population of around 1.4 billion, wherein people are hardworking people and want a better life for their children. They will continue to be productive. One way to create productive work is through government investments in the absence of private investments. We should take advantage of our young population. If growth comes back, there will be no problem in revenue generation. If a businessman does not make a profit, he will not pay taxes. So, the only people who will pay taxes will be individuals. If we burden individuals with higher taxes, then it will impact our ability to grow in the long run.

We have paid the same price for petroleum whether oil was at $150 a barrel or at $50. We have effectively taken away Rs 2.5 to 3 lakh crore from household consumption towards the government. We have been excessively focused on fiscal deficit and trying to use indirect taxation for generating revenue, rather than saying that if growth happens, revenues would automatically go up.

The government announced several stimuli that it hoped would put more money in the hands of people and boost the economy. But these were not enough by its own admission. Also, some economists opined that the government should have done more to increase the purchasing power of people; it should have printed more currency like what Brazil had done, while others said it would impact the economy in the long-term. What is your view?

The component of economic or fiscal stimulus was small. When government increased wages under MGNREGA or hiked wages, money did go into the hands of people. The other was the announcement of credit availability. But when the situation is uncertain, any sensible person or business leader will not borrow money. Indians are conservative by nature. We borrow money to invest in our children’s education, housing, and transportation and not to consume like the Americans. Our consumption will not be driven by credit availability. If uncertainty of jobs or earnings looms, there is no point of offering money to people. We also do not have a social security system, so people will be discouraged from spending more. To me, credit availability will not kick-start the economy. The government’s responsibility is to give confidence and help society steer through the crisis. The government should invest more in healthcare, education, and public transportation to reduce the cost of living for the vast majority. Investments in these three sectors would create more employment opportunities within 1-3 years.

There is a perception among some sections of society that the government has constraints for not being able to do more to address the pain points that emerged due to pandemic. Do you agree with the line of thinking?

We can definitely give more. Last year, we made a policy choice of reducing the corporate tax, which was completely misplaced at a time when we knew that investment revival could not take place. In India, capacity utilisation has been running below 70% for some time. Besides, when we can import goods and services from anywhere in the world at substantially lower costs and countries like China can offer productive capacities to keep our costs low, it is unlikely for a corporate leader who cares for shareholders to invest only to save taxes. So, Rs 2 lakh crore-odd corporate tax reduction was a misplaced policy choice, as the money could have been spent on education, healthcare and public transportation. Today, our economy would have been better even if the money was invested in these sectors last year; this investment would have created its own cycle benefiting small contractors, labourers, and others whose spending would have generated the next cycle. The corporate tax reduction benefits have gone to some of the most profitable companies in the country, including those engaged in consumer products, whose investments requirements are extremely low.

We are also witnessing that our GDP to tax ratio has been stagnant. We are using more indirect taxes as a percentage of GDP. This is hurting people as it is compromising our ability to grow.

In the face of US-China trade war and the Covid-19 pandemic, many companies are shifting or contemplating shifting their global supply chains out of China and to India and South-East Asian countries. Will China cease to be the world’s manufacturing hub?

In my assessment, China will continue to be the world’s manufacturing hub for a very long time. There are two reasons. Firstly, China’s manufacturing productivity over the last 30 years has been 8%. India can match China’s population and scale but has manufacturing productivity half of theirs. Therefore, goods that we would produce for the world will be at a cost double that of China’s in that sense. Secondly, China’s factories have always been built for global demand. The level of automation of their factories has always been higher compared to a typical Indian factory. So, their scale and labour productivity put together gives China a significant advantage. Unless we can catch up with China in the next 5-10 years, they will continue to dominate the manufacturing supply chain. Their cost of living is lower than of the US and Europe. The real median income in the US is not growing for the last 30 years. If the US has to keep cost of living of its people low, it has to depend on China; it has no choice.