Affordable housing gap widens in India as supply falls to 0.36 units per sale, warns a Knight Frank and NAREDCO report.

The affordable housing gap in India is growing, with the supply-to-demand ratio across the top eight cities plunging from 1.05 in 2019 to 0.36 in the first half of 2025, according to Knight Frank India and the National Real Estate Development Council (NAREDCO). The report, Affordable Housing: Tackling Urban Housing Deficit Through Supply-Side Reforms, highlights the worsening imbalance in the sector.

This trend marks a reversal from earlier years when developers launched more affordable homes than were sold, aided by schemes such as Pradhan Mantri Awas Yojana (PMAY). In 2025, launches have shrunk to a third of sales, deepening the affordable housing gap and limiting buyer choices.

Demand Policies Help, Supply Lags

Over the past decade, schemes like PMAY, Affordable Rental Housing Complexes (ARHCs), and tax benefits supported buyers. However, supply remains inadequate due to high land prices, financing barriers, regulatory delays, and weak infrastructure in urban peripheries.

“Affordable housing is not only a social priority but also an economic necessity,” said Shishir Baijal, chairman and managing director, Knight Frank India. “While demand-side policies are commendable, there is an urgent need to ease supply barriers. Faster approvals, land availability, and innovative financing will be key.”

Deficit May Surge to 30 Million Units

India’s current affordable housing shortage is 9.4 million units. By 2030, demand could rise to 30 million, with nearly 80% concentrated in economically weaker and low-income groups.

The share of affordable homes—priced below ₹50,00,000—fell to 17% in early 2025, down from 52.4% in 2018. Shrinking launches and minimal private investment are widening the affordable housing gap.

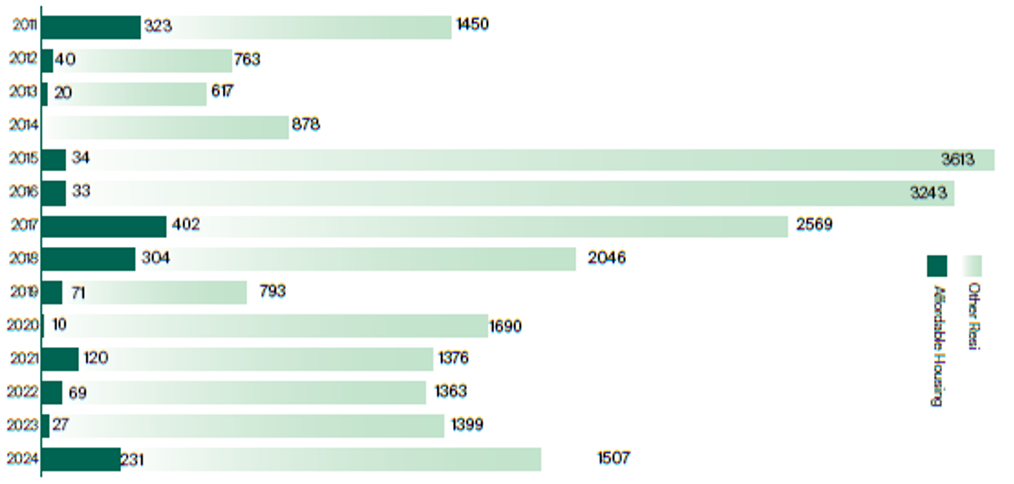

Private Equity Inflow into Residential Sector (USD mn)

Source: Venture Intelligence, Knight Frank Research

Limited Private Capital

Between 2011 and 2024, private equity inflows into affordable housing totalled $1.9 billion, only 7.8% of the residential sector. Foreign capital accounted for just 10.2% of this between 2019 and 2024.

“The sharp decline in supply relative to demand demonstrates the urgent need for structural reforms,” said Gulam Zia, senior executive director–Advisory, Valuation, and Research, Knight Frank India. “High land costs, inadequate investment, and poor infrastructure continue to restrict developers. Without targeted incentives, the segment will remain underserved.”

Call for Supply-Side Reforms

At the 17th NAREDCO National Convention, President G Hari Babu stressed, “The deficit of 9.4 million units could rise to 30 million by 2030. The sharp drop in new supply is alarming. Unlocking PSU land, rationalising FSI norms, and subsidised construction finance are needed to restore affordability and draw private participation.”

The report recommends:

– Repurposing PSU land for affordable housing via public-private partnerships.

– Increasing floor space index (FSI) to cut costs and boost supply.

– Providing subsidised construction finance, drawing on global models.

– Creating an ecosystem where private participation becomes financially viable.

A Way Forward

India’s affordable housing gap is not insurmountable. With aligned policies, innovative financing, and stronger private sector engagement, the country can meet demand while building equitable, resilient, and inclusive cities.

ALSO READ