A set of new catalysts is driving the Indian bathroom industry, and the key players are responding by pivoting from their core competencies to become complete solution providers

The domestic plumbing industry can broadly be divided into three categories: sanitaryware, bath fittings, and pipes. The estimated size of the sanitaryware industry is Rs 4,400 crore, with unorganised players catering to about 40% of the market. The sector is projected to grow at a compounded annual growth rate (CAGR) of 8-10% over the period 2017-20. The bath fittings industry is estimated at Rs 8,000 crore, with unorganised players comprising about 50%. This sector is expected to record a CAGR of 13-15% during the same period. The plastic pipes industry is pegged at about Rs 30,000 crore and is expected to grow at a CAGR of 14%, with unorganised players representing 35-40%.

Growth Drivers

Disposable Income: The country’s middle-class population is likely to double between the years 2016 and 2026, with the working-age group (15 years and above) set to account for 64% of the total population by 2020. Such favourable demographics will strengthen the nation’s disposable income, and consequently bolster demand for discretionary products. It is being seen that an increasing number of consumers now perceive premium bathroom products, home décor and furnishings as style statements. As the prosperity index increases in tier-II towns, the demand for superior and premium products from these geographies will attain a sizeable scale.

Bathroom is the ‘I’ Space

Over the years, a profound shift has taken place in the bathroom category. Bathrooms have evolved from a

functional space to a form of personal experience and self-expression. As a result, there is a far higher buyer

involvement in the selection of products. The category has moved from being a commodity to an advanced and highly differentiated offering. Consumers are also looking at creating spa-like experiences at home to make their bathrooms a seamless extension of their lifestyle. By recognising this fundamental trend, German sanitaryware and bath furniture major Duravit is steadily raising awareness about the rejuvenating and healing aspects of bathrooms through its communications and is giving shape to the vision of customers who value personal space and wish to enjoy it the fullest.

Replacement Market

Driven by renovations and up-gradation in line with emerging trends, the replacement demand for bathrooms is

projected to grow at a steady pace. The increasing awareness of polymer pipes is fuelling demand for replacement

of metal, and particularly in favour of CPVC and uPVC based plumbing. Investor-backed tech platforms such as

Livspace, Arrivae and Homelane, which provide 360-degree services including design, selection and installation

of home improvement products, are making it easier for customers to start home projects. The recent transformation of Housejoy, from a home services aggregator to turnkey construction contractor, is further indication that investors are putting money into ventures that can address the service gap in the interiors market. Thus, there is significant headroom for growth of the replacement market in the building products industry.

Urban Infrastructure

Budgetary expenditure for bolstering infrastructure is estimated at Rs 5.97 lakh crore over FY 2018-19, with

programs driven primarily by state governments and the centre. Andhra Pradesh, Gujarat, Karnataka, Rajasthan,

Telangana and Uttar Pradesh are attracting investments in Urban Water Supply & Sanitation (WSS) projects and

will be the primary demand-creators for plumbing solutions.

Budgetary allocation for 2019-20 for some of the flagship programs is Pradhan Mantri Awas Yojana-Urban (Rs 6,853.26 crore); Atal Mission for Rejuvenation and Urban Transformation-AMRUT (Rs 7,300 crore); Smart Cities Mission (Rs 6,450 crore); Mass Rapid Transit System-MRTS (Rs 19,152 crore).

Drawn by the government-driven demand for sanitation, Lixil Group has launched its tailored Sato series of toilet products in India. Sato is a twin-pit pour-flush (TPPF) latrine. Its V-trap connects the two pits to make switching between them easier, and thus eliminates clogging besides requiring 80% less water per flush. Lixil is eyeing the emerging toilet-sanitation market which has been triggered by the government’s Swachh Bharat Abhiyan.

“Over the last year, we have scaled our efforts to improve access to safe sanitation for communities around the

world, including in India. By supporting the Swachh Bharat Mission in India, we can make a real contribution to

solving the sanitation crisis,” said the Lixil’s executive officer and senior managing director Jin Montesano. “We believe that offering innovative, safe, and affordable solutions can aid in eliminating India’s struggle against open defecation.

Another innovation has come from startup Sanotion. This company’s founder-director Satyajit Mittal has designed SquatEase, an Indian pan that makes squatting more comfortable, besides solving a gamut of hygiene and behavioural issues. SquatEase earned Mittal the iF Public Value Student Award in 2016 and Swachh Bharat

Puraskaar in 2018. Around 5,000 SquatEase pans were installed at the Ardh Kumbh Mela in Prayagraj in 2018.

The Indian bathroom and plumbing industry is also witnessing trends that are shaping the growth strategies of key players, besides providing a business template for others. Among them pivoting as a bathroom solutions provider, engaging directly with buyers through experience centres, investing in skill development, and evangelising water conservation are the most significant.

Bathroom Solutions:

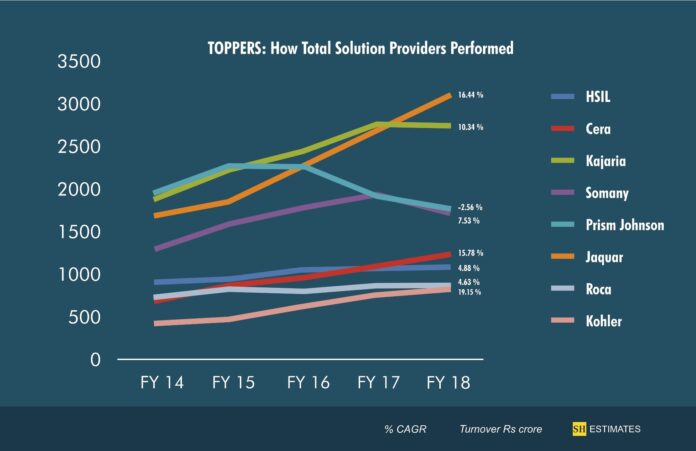

The ‘total solutions’ bug has bitten the industry, and players see value in being a master of all. By leveraging their brand values and existing distribution networks, they want to capture a larger share of the customer’s purse when it comes to bathrooms and plumbing. From being specialists, they are now seamlessly moving across the domains of sanitaryware, tiles, bath fittings, pipes and fittings and wellness solutions.

The Rs 2,753-crore bath fittings behemoth Jaquar Group recently took over the manufacturing plant and other assets of Kutch-based tile maker Euro Ceramics Ltd in a Rs 100-crore deal. This strategic deal catapulted Jaquar’s manufacturing infrastructure to over 248,000 sqm, spread over five plants in India and one in South Korea. According to the company’s promoter and director Rajesh Mehra, “This acquisition would give us a leadership position and strengthen our proposition of being a complete bathroom solutions provider.” The company already markets a range of sanitaryware which it sources from Asian and European manufacturers.

Tiles titan Somany Ceramics Ltd has introduced French Collection fittings in the premium segment, to strengthen

its position on the bathroom platform. “The new collection will strengthen our portfolio and help us to expand

our consumer base,” the company’s managing director Abhishek Somany has said. Somany has also stated his aim

to clock 30-40% growth in the newly set up sanitaryware business, which is aligned to the overall goal of becoming a Rs 3,000-crore turnover company by 2020.

Roca Bathroom Products has forayed into the household plumbing segment by introducing CPVC pipes and fittings, which are used for potable hot and cold water distribution. “The company’s foray into the CPVC segment makes it a one-stop solution for all bathroom needs,” said K E Ranganathan, Roca’s managing director. HSIL too became a pipe maker by setting up a plant in Hyderabad in 2018. It also markets a wide range of bathroom fittings and kitchen sinks, besides water heaters, air purifiers and ventilation fans under the Moonbow brand.

The transformation of Kajaria, the nation’s largest ceramic tile maker, into a bathroom fittings company, following it’s setting up of a sanitaryware and a faucet plant, literally closes the discussion. No other player has so assertively covered the bases of tiles, sanitaryware and faucets as Kajaria, in a clear indication that it’s going to be all or nothing in the quest for the customer’s budget.

Experiential Retailing:

Consumers are increasingly focusing on lifestyle considerations rather than on the need for functional necessities in categories such as consumer durables and bathroom fittings. The level of involvement of women and family in bathroom design and product selection has also increased significantly. Consumers are looking to use digital tools at the point of sale, to help them understand and experience products in an engaging atmosphere. This has resulted in increased up-gradation of retail shops into expert stores with trained staff.

Establishing experience centres – company-owned showrooms with real-life settings – is becoming the done-thing. Brand owners realise the limitation of their dealers in doing justice to their vast product ranges. More importantly, they want to save their customers from the price-driven pitch of the markets and instead present a proposition based on performance and aesthetics as their key differentiator.

Jaquar, considered the pioneer in the art of experience centres in the bath industry, is setting up a grand display centre in Market of India, which is coming up at SPR City in Chennai. The company’s latest display centre (it has 21 across the country) will provide service support to its customers in the region. It will enhance their experience as they check out the bespoke range of bathroom and lighting solutions.

The company has signed an MoU with SPR Group, the real estate developer to this effect. As part of the MoU, while

Jaquar will set up its display centre, the real estate developer will use Jaquar products in the SPR City project. To mark the partnership, and as a novel CSR initiative, Jaquar and SPR Group have planted over 1,000 saplings within SPR City which will have over 5,00,000 sft of green space spread across the property. “The centre will feature complete bathroom vignettes with demonstration spaces for rain shower enclosures and freestanding bathtubs as the customers interact with specialists, etc.,” says Mehra.

HSIL in 2017 inaugurated its Lacasa concept store in Surat, Gujarat. The 3,000 sft experiential store is digitally-integrated at every point. It provides a combined online-offline experience so that consumers can select products on a smart device and drop them into a screen for real-time expert consultancy. The store takes consumers on an exhilarating journey, by displaying beautiful combinations of premium and luxury products ranging from faucets, showers, washbasins, chromo showers, bidets to WCs. HSIL plans to open 10 Lacasa stores across India as part of its 2020 vision.

Skill Development:

A dearth of trained plumbers is a significant hurdle in the growth path of the country’s construction sector and the allied bathroom industry. Therefore skill development is being taken very seriously by the industry, with several initiatives taking off in tandem with the efforts of the Indian Plumbing Skills Council (IPSC). Skilling is expected to help beneficiaries improve their workmanship and potential of employment, while also cementing the linkages of post-sales support with accurate installations.

Project Nadee, the flagship skilling program of Japan-headquartered building materials major Lixil Group, is aligning itself with the government’s Skill India mission. Lixil, which owns the Grohe and American Standard

brands, has launched this project for uplifting the livelihoods of plumbers and empowering them with skills,

training and certification. The company expects to address the demand and supply gap for this crucial skill in the industry, and more importantly, make the trade aspirational for plumbers. “Under Project Nadee, Lixil aims to

upskill and certify 20,000 plumbing technicians as commercially licensed plumbers, along with and in compliance with the relevant qualification standards as approved by IL&FS Skills Development Corporation Ltd.”

“While business performance and strategy are important for any market, we at Lixil take pride in doing more for

the communities in which we operate. To this end, we have launched Project Nadee, which aims to transform the

industry in a 360-degree way. This massive project is in line with Lixil’s aim of transforming the end-to-end home solutions experience, and make it easy, enjoyable and of true value to the consumer,” says Bijoy Mohan, CEO for Lixil Asia Pacific. “With Project Nadee, the company is taking the lead in creating a digitally enabled platform to solve a problem that has the potential to hinder industry growth if not resolved. Being a leader in the industry, Lixil is best placed to address the issue as it can influence the entire value chain towards this purpose.”

Roca has partnered with IPSC to train 700 women and a total of 1,600 beneficiaries across India in the field of plumbing. Accordingly, a skill development program under Recognition of Prior Learning (RPL) will be conducted by IPSC for the plumbing workforce, with a particular focus on women. A joint project of one year, the RPL program aims to empower beneficiaries with the right skillsets for enhanced employment opportunities. Through training

modules, the programs aim to touch base with plumbing communities in metro cities like Delhi/NCR, Mumbai,

Kolkata, Chennai, Hyderabad, along with tier II and III cities across India.

Ranganathan has stated, “We are delighted to announce our association with IPSC to help inculcate the desired

skills among the existing plumbing technicians. We are also happy to note that women are breaking stereotypes by joining the profession.”

Water Conservation: Bathrooms account for the most significant water usage in homes. With increasing environmental awareness, users prefer eco-friendly fittings that can help them to conserve water. Savings of up to 20% can be achieved through the use of high-efficiency flushing systems, infrared controls, sensor taps and showers and homeowners do not want their bathrooms to be on the wrong side of water consumption.

Schell India unveiled self-closing technology which uses water pressure in the plumbing system, subject to a minimum required pressure, to close the valve. The technology incorporates a self-cleaning mechanism by means

of a jet needle, giving a unique aspect to taps, WCs, urinal flush systems and showers. The mechanism regulates

water outflow from 600 ml upwards per use. Schell’s WC flush systems regulates water outflow from 4.5 litres per flush. Similarly, the showers limit flow rates to 10 lpm between five to 30 seconds, thus ensuring significant savings in water consumption.

Also read: The Transformation of Watertec